Want to Improve Your Pitch? Stop Talking to Founders

One of the most important resources that any startup founder can possibly have is a trusted group of peers to talk to. Whether it’s getting feedback on product, tips for go-to-market or simply venting / decompressing in a safe space, a pit crew of other founders is invaluable.

But there’s one area where talking to founders can steer you wrong: your fundraising pitch.

Creating a pitch deck typically involves the following steps:

Scour the internet for blog posts, templates and examples to use as a starting point (or use AI)

Create v1 of the deck

Get feedback and iterate

Step 3 is where things can go off the rails for founders — and it’s all because of who they talk to: the vast majority of founders start by getting their feedback from other founders.

Why is that a problem? After all, conventional wisdom holds that having a solid pit crew of other founders is one of the best resources you can have (heck, I just told you as much).

It’s simple: most founders don’t actually know what matters to investors in a pitch — even (especially?) if they’ve successfully raised money before.

What Do Investors Care About?

Let’s start with the basics: what matters to investors in a fundraising pitch?

Every investor is different, but in general all VCs and angel investors want to understand the following:

What problem are you’re solving?

How big is the problem?

What is your solution?

Why is your solution new/innovative/different?

What evidence do you have in support of your hypothesis?

Who are you and why are you the team to do this?

What have you accomplished so far?

The astute reader will notice that only two of these things are related to product (3 and 4). Yet the vast majority of founders presume that product is the most important part of an early-stage pitch.

But investors don’t invest in products or product ideas. They invest in companies.

This simple distinction trips up a lot of first-time founders, but it’s crucial to understand. Your product (or product idea) is a key part of your pitch, but it’s only one part of the story. Good investors will, of course, spend a considerable amount of time on your product, but the other points are just as important when it comes to creating a full portrait of your company’s true potential.

It makes perfect sense that founders gravitate so often towards product. After all, that’s what you spend the vast majority of your time on. When you meet other founders, they generally want to geek out about what you’ve built — which is exactly why their pitch feedback disproportionately relates to product.

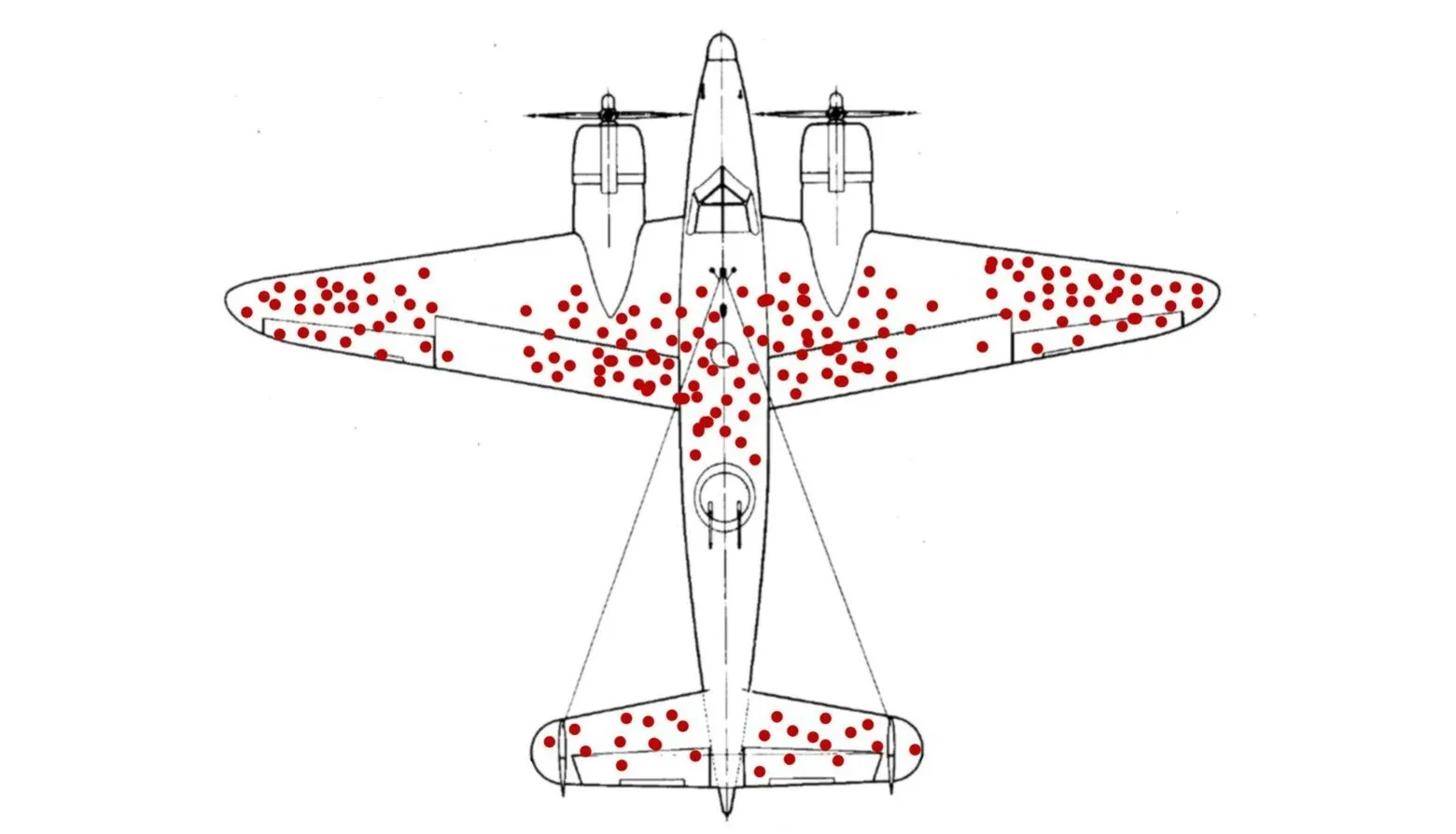

Founders who have successfully raised capital can be even worse, as they tend to fall victim to survivorship bias in their feedback.

More emphasis on product!

Founders who believed that part X of their pitch was the key to their success in fundraising will tell you that part X of *your* pitch must also be the most important part. Unfortunately, very few founders actually fact-check this with the investors who gave them money.

So how can you get more complete, well-rounded feedback on your pitch? Intentionally source feedback from a variety of sources:

Founders: Does the pitch make sense? Can they understand it?

Subject-matter experts: Is the pitch credible to experts and industry insiders?

Non-tech friends and family: Does the pitch make sense at a conceptual level? Can they understand it even without a strong technical background (this is important for two reasons: (1) many investors you meet won’t be experts in your space, and (2) many investors want to know that you can pitch to non-experts, given how important that skill is to company building)

Angel investors: Does the pitch resonate as a potential investment opportunity?

VCs: Does the pitch resonate with how VCs, specifically, think and invest?

This might seem easier said than done, particularly if you don’t have an extensive network. Not only is it possible, it’s pragmatic and well worth the effort.

Feedback from groups (1) - (3) should be easy to obtain, since you should already know multiple people in those groups. (4) and (5) is actually quite obtainable, given how many VCs and angel investors hold office hours, engage with incubators and accelerators, and otherwise make themselves accessible to founders as part of their deal flow strategies. You can also try reaching out to a small, targeted set of investors to get more precise feedback (this post on How to Create a Dotted Line with VCs discusses how to do this in more depth).

Regardless of your approach, just remember not to over-index on any one person’s feedback (including the one or two VCs you might talk to). With a diverse audience, you’re very likely to get feedback that’s all over the place — and some that directly contradicts each other. Filter the feedback you receive through the lens of who provided it and how much experience they have making investment decisions (also keep in mind that there are 9 different types of startup investors, each of which tends to focus on something different).

Last point: expect that you will very likely receive entirely new and unexpected points of feedback when you start pitching investors for real. Why? Because investors pay a little more attention and think about things more seriously when they’re genuinely considering an investment.

Good luck!