The Mythical U.S. Lead Investor

A few months ago, an early-stage Canadian VC called Two Small Fish announced their third fund (woo hoo! 🎉). In covering the announcement, one of the local tech publications included this quote:

Suffice to say, I was annoyed. Because this is simply not true.

I expressed my annoyance on Twitter, only to be met with a stream of opposing responses, like this one:

This deeply-held stereotype — that local investors don’t lead rounds, but “foreign investors do” — exists not only in Canada, but in tech ecosystems all over the world. There is a pervasive belief amongst founders and ecosystem supporters that goes something like this:

Investors here don’t take risks

Investors here don’t back early companies

Investors here don’t lead rounds

But…

U.S. investors take risks and move fast

U.S. investors back ideas on napkins

U.S. investors don’t care who else is in the round

To most folks in Startupland, this perspective seems completely reasonable — especially if the main lens through which one learns about Silicon Valley fundraising is the selectively-chosen, click-bait funding announcements that permeate tech media these days. But that’s not reality.

While it’s true that a handful of repeat founders are able to raise funding with little more than “an idea on a napkin,” that’s far from the majority case (it certainly wasn’t my experience).

It’s also true that, in general, Silicon Valley investors move faster than investors in other geographies. But that’s not because they’re “better” investors, it’s because the competitive dynamics in Silicon Valley demand it. In Silicon Valley, speed is a key dimension on which investors compete. They’ve learned to do so over many years (and, no, VCs don’t “skip” diligence). There are only a handful of other geographies around the world where investors are starting to compete on speed — and it’s mostly ecosystems that Silicon Valley VCs have set their sights on.

I could go deeper into the subtleties involved in comparing Silicon Valley investors with investors in other geographies, but I’m pretty sure that most of you reading are still thinking this:

So instead of talking (writing?) until I’m blue in the face, let’s take a look at the data.

I’ve previously noted that there’s no such thing as accurate Pre-Seed data. A big reason for this is that the details of many Pre-Seed rounds (and a significant number of Seed rounds) aren’t made public until long after they’re closed.

In order to account for this dynamic, we’ll look at six years of Crunchbase funding data from 2016 through 2021. Given that the typical length of time between funding rounds is 18 - 24 months, it’s reasonable to presume that the majority of rounds that took place during those years have now been made public (at least, for companies that still exist).

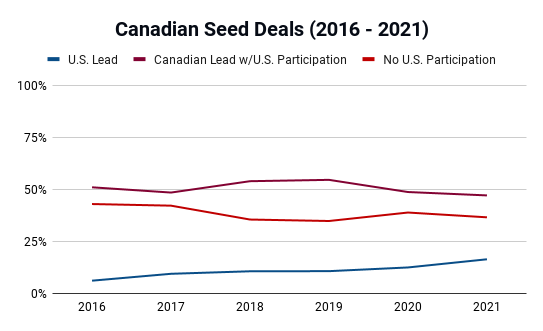

As a starting point, let’s look at all Canadian Seed deals that occurred between 2016 and 2021 and split them into three categories:

Canadian Seed deals with a U.S. lead

Canadian Seed deals with a Canadian lead and U.S. participation

Canadian Seed deals with no U.S. participation

For each of these years, fewer than 20% of Seed deals that occurred in Canada had a U.S. lead investor.

You might be thinking, “but that blue line is moving up each year…” and you’d be correct. More Canadian deals are being led by U.S. investors each year. But that fact doesn’t in any way imply that Canadian investors are reticent to lead deals. Rather, it speaks to the maturation of the Canadian startup ecosystem in two important ways:

More U.S. investors are paying attention to — and investing in — Canadian startups

More Canadian founders have the confidence and willingness to raise capital south of the border (as I’ve said before, Canada’s problem isn’t ambition)

Want proof? Here is a chart showing the number of US investors that participated in at least one early-stage funding round (Pre-Seed or Seed stage) for a Canadian startup over the same time period:

The number of U.S. investors participating in at least one Pre-Seed or Seed stage funding round steadily increased each year between 2016 and 2021. That’s a great thing — it means more capital flowing into Canada’s tech ecosystem and more options for Canadian founders — but U.S. investors still represent only a small fraction of the capital deployed into early-stage funding rounds in Canada.

“Hmm…” you might be thinking. “Your earlier chart only showed Seed deals. What about Pre-Seed deals? Canadian investors don’t lead Pre-Seed rounds!”

Let’s take a look at Pre-Seed deals between 2016 and 2021 in the same fashion:

If you look at the blue line in the above chart (the percentage of deals led by U.S. investors), it is almost identical to the one for Seed deals. As with Seed deals, in each of the years 2016 - 2021, fewer than 20% of all Canadian Pre-Seed deals were led by U.S. investors.

(If you’re wondering about the spike in participation by U.S. investors in 2021 — the dark red line — you can thank Covid. While we were all stuck at home, many U.S. Pre-Seed investors started investing internationally, with Canada the main beneficiary. In the years since, the number of Canadian-led Pre-Seed deals with at least one U.S. investor has steadily remained above 50%.)

To bring this all home, let’s combine the data for Pre-Seed and Seed deals into a single chart (which is helpful anyways, given that the terms are not used consistently):

And there you have it. Each year over the six-year period from 2016 through 2021, less than 20% of all early-stage Canadian rounds were led by U.S. investors. Or, put differently, more than 80% of all early-stage Canadian rounds during that time period were either led by Canadian investors or were syndicates (e.g. angel rounds) without any American participation.

Those numbers are slowly changing (as the number of U.S. VCs investing in Canadian companies continues to increase) but the vast majority of Canadian early-stage deals continue to be led by Canadian investors. And that’s not going to change anytime soon (at some point, I’ll write a separate post on why this is the case).

In the meantime, let’s take a look at another leading tech ecosystem for the sake of comparison. Here is a breakdown of U.K. early-stage deals during that same period of time:

In the U.K., fewer than 10% of early-stage rounds are led by U.S. investors. In fact, the participation rate by U.S. investors is lower across the board (in Canada, approximately 70% of early-stage funding rounds include at least one U.S.-based investor, while in the U.K. that number sits around 35%) . But if you focus on the shape/slope of the blue line, they are very similar. This is because the U.K. startup ecosystem is currently undergoing a similar evolution to what’s happening in Canada:

More U.S. investors are paying attention to — and investing in — U.K. startups

More U.K. founders have the confidence and willingness to raise capital across the pond

But the percentages are much smaller — and are unlikely to ever reach the same levels as in Canada. For starters, there are additional complexities for U.S. funds wanting to invest in U.K. entities. And even when those aren’t a factor (such as when a U.K.-based startup incorporates in Delaware), American investors often hesitate to invest in European companies at the early stages (something I saw firsthand while running Commonwealth Ventures). A big part of that simply has to do with proximity.

For better or worse, Canada’s startup ecosystem is increasingly impacted by being treated as America’s “51st state”.

But I’m not done looking at data just yet.

Next, let’s look at America.

That’s right. Let’s take a look at startup funding in the United States.

Specifically, let’s take a look at the fundraising reality of early-stage American startups based outside of California.

Here is a breakdown of early-stage funding for U.S. companies based in the 49 states whose flags don’t include a grizzly bear, using a similar categorization:

Non-California deals with a California lead

Non-California deals with a non-California lead and California participation

Non-California deals with no California participation

Look familiar?

That’s right, the experience of early-stage American founders located outside of California is virtually identical to that of international founders when it comes to raising from Silicon Valley.

If you’ve ever participated in one of my accelerators, I start off by stating that there are exactly three funding ecosystems in the world:

Silicon Valley

China

Everywhere else

And this is a perfect demonstration of that.

This post barely scratches the surface of these dynamics (trust me, I’ve got plenty of adjacent topics for future blog posts). For now, if you take anything away from this analysis, it’s the following:

Silicon Valley is a global outlier when it comes to fundraising dynamics.

In the rest of the world, early-stage funding rounds are overwhelmingly led by local investors.

U.S. participation in early-stage Canadian funding rounds is higher than anywhere else in the world — including in most U.S. states (which is either a blessing or a curse, depending on whether you’re a hungry startup looking for funding or a Canadian investor wary of competition).

That, and the fact that the mythical U.S. lead investor does not exist.

Or does she...?