Give Your Customers What They Want

For this week’s post, I’m going to start off with a case study that isn’t from the annals of Silicon Valley (although many in the tech world are loyal customers of this industry). Today, we’re going to talk about fast food. Specifically, we’re going to look at the astonishing rise of A&W Canada.

If you’re reading this from the U.S., you’re probably scratching your head right now (in all likelihood, you haven’t been inside of an A&W in years and, if you have, your experience was likely…not great).

A&W Canada is a completely separate company from A&W Restaurants, which operates A&W in the U.S. and elsewhere. You can read the full history here, but the tl;dr is that A&W Canada split from the US company in 1972 when it was sold to Unilever. A group of Canadian franchisees subsequently bought the company back in 1995 and have operated independently since then. Not only is the Canadian company larger than A&W Restaurants (by both number of stores and revenue), many of the popular menu items and brand assets (including the chain’s bear mascot) were created by A&W Canada and licensed to A&W Restaurants.

Ok, so let’s jump into the case study.

Back in the early 2010s, fast food chains were going through an existential crisis as millennials led a massive shift towards healthier eating. Quick-service restaurants (QSRs) around the world were seeing sharply decreasing sales and rushed to introduce new menu items in order to stem the bleeding. McDonald’s introduced McWraps and egg white sandwiches, Taco Bell added herb-grilled chicken and cantina bowls, while Burger King unveiled turkey burgers and low-sodium french fries. But A&W Canada took a different approach.

At the time, A&W Canada was having its own crisis of identity. Although it was the fifth-largest QSR in the country, its growth was stagnating.

“We were seen as not being very connected with consumers and being out of date, out of style, out of touch, outmoded, not very relevant,” said [Trish] Sahlstrom.

Rather than rush to introduce new menu items as many QSRs were doing, A&W Canada initiated a deeper strategic planning process centred on “dramatic changes in consumers’ attitudes and behaviours.”

“We saw, for instance, an increasing desire among consumers to know who and where their food was raised,” she said. “Consumers were saying, ‘Where’s the evidence? I no longer trust just that it tastes good. I want to know where it came from. I want to know who has raised the animals that are feeding us. I want to know your values, A&W.’”

The company then asked what factors came into play when consumers wanted a hamburger.

“As we started to put together all of these pieces of evidence — all of the answers to these questions — what came out incredibly strong and clear to us was leave out the hormones and steroids and don’t use the antibiotics.”

A&W Canada stumbled on an epiphany that, surprisingly, seems to have been missed by most other QSRs: their customers didn’t want them to change their menu per se, they just wanted to feel better about eating there. A&W customers didn’t want to buy a salad or a wrap or a gluten-free super food quinoa bowl when they visited one of the company’s restaurants. They simply wanted a slightly healthier hamburger.

So in 2013, the company announced that all of its burgers would be made with beef raised without hormones, steroids or other additives.

Following the announcement, the Canadian beef industry was up in arms. The move required A&W Canada to source beef from the U.S. and Australia, as there weren’t enough ranchers in Canada at the time raising cattle that met their requirements. The industry responded with a public relations campaign and attempted boycott of A&W, but failed miserably.

Same-store revenue for A&W Canada increased 6.3% the following year, while a consumer research study by QRI subsequently found that “89% of burger eaters [in Canada] were “impressed and interested that A&W is serving beef raised without added hormones or steroids.” (By contrast, McDonald's same-store sales decreased in 2014 — falling by -2.1% in the U.S. and -1.0% globally)

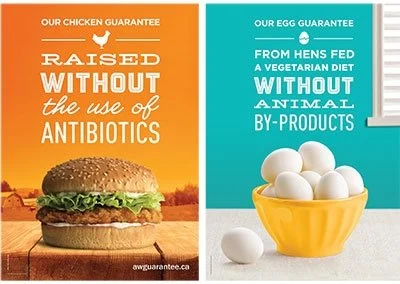

A&W followed up the success of its “better beef” campaign with similar shifts to its chicken and egg supply chains in 2014.

The sustained focused on healthy ingredients resulted in even greater success in 2015, with same-store revenue increasing 7.6% that year. Total revenue for 2015 topped $1 billion — the first time in the company’s history — while its share of the QSR market in Canada increased from 12.7% in 2013 to 14.4% in 2015. And the company hasn’t taken its foot off the gas since.

In 2018, A&W Canada became the first QSR in the world to introduce Beyond Burgers nationally. That same year, the company further evolved its egg supply from vegetarian-fed to cage-free and antibiotic free eggs. And in 2020, it shifted its burgers to 100% Canadian, grass-fed beef.

And the results showed. With the exception of 2020’s Covid-driven drop, A&W Canada outpaced the world’s largest QSR brands on same-store sales for many of the years following this strategic shift.

So what does this have to do with tech?

A&W Canada’s recent successes were the result of a management team that, amidst a groundbreaking shift in consumer preferences, took the time to stop and ask the question, “what do our customers really want?”

Today, the technology world is undergoing a similarly unprecedented shift as AI rapidly permeates every aspect of our industry. As I look around, I see countless companies of all shapes and sizes rushing to plug AI into their offerings without stopping to ask themselves, “is this what our customers really want?”

Services businesses trying to become product companies, “so our customers can do it themselves”

Product companies replacing interfaces that their customers have grown to love with text-based prompt interfaces, “because that’s how AI works”

Business intelligence / data analytics startups rushing to leverage AI so that “business users can directly query the database” (trust me on this one 😉)

While it’s inevitable that AI will fundamentally change many aspects of our lives, it’s important that founders take the time to think about the shift from their customers’ perspective. In some cases, AI will completely upend a category and, thus, require a total rethink of a company and its products. But I suspect in many industries, customers will simply want a faster, more powerful, AI-enabled “hamburger”.