Anatomy of an Ecosystem

Last week, I had the privilege of hosting the second iteration of what’s fast becoming an annual celebration of startups in Vancouver and the surrounding ecosystems: BC Founders Day.

BC Founders Day originated from a simple idea: what would happen if we put up-and-coming founders from across British Columbia in the same room with dozens of experienced founders from startups past? It turns out, a lot.

The day consisted of three parts:

A mini conference with experienced founders sharing insights from their startup journeys (with a few VCs sprinkled in for good measure)

Founder-only office hours, where founders could meet and ask questions of the speakers and dozens of other experienced founders

A community networking event where founders, investors and supporters from across the ecosystem celebrated together

For an event like this to have maximum impact, curating the attendees is key. I’ve written before about the emphasis that high achievers place on meeting other high achievers when deciding whether or not to attend an event,

“The most ambitious people I know are drawn to other high-achievers. They want to learn from them, connect with them and be surrounded by them. Creating an event focused on the opportunity to meet other high-achievers can be a big draw. The most impactful events often take it a step further by focusing the audience around a specific theme,”

A big draw of BC Founders Day is that a significant portion of the event is only open to founders. Advisors, brokers, recruiters, consultants, fractional CXOs, salespeople and even investors are only permitted to join the community networking event. The result is a safe space where founders (and aspiring founders) from across the ecosystem can engage with each other on any topic they feel drawn to.

70+ speakers and OG founders wore Hawaiian leis during the founders-only office hours to identify themselves as mentors

In order to achieve this, we have to meticulously validate each attendee’s background and establish whether or not they are, in fact, a founder. That process gives us some pretty interesting data. Which got me thinking: with nearly 1,000 registered attendees this year (a 25% year-over-year increase 😉) we’ve created a pretty good snapshot of the BC startup ecosystem. So why not share it?

Let’s take a look at the startup ecosystem in Vancouver and the surrounding region through the lens of BC Founders Day…

Attendee Breakdown

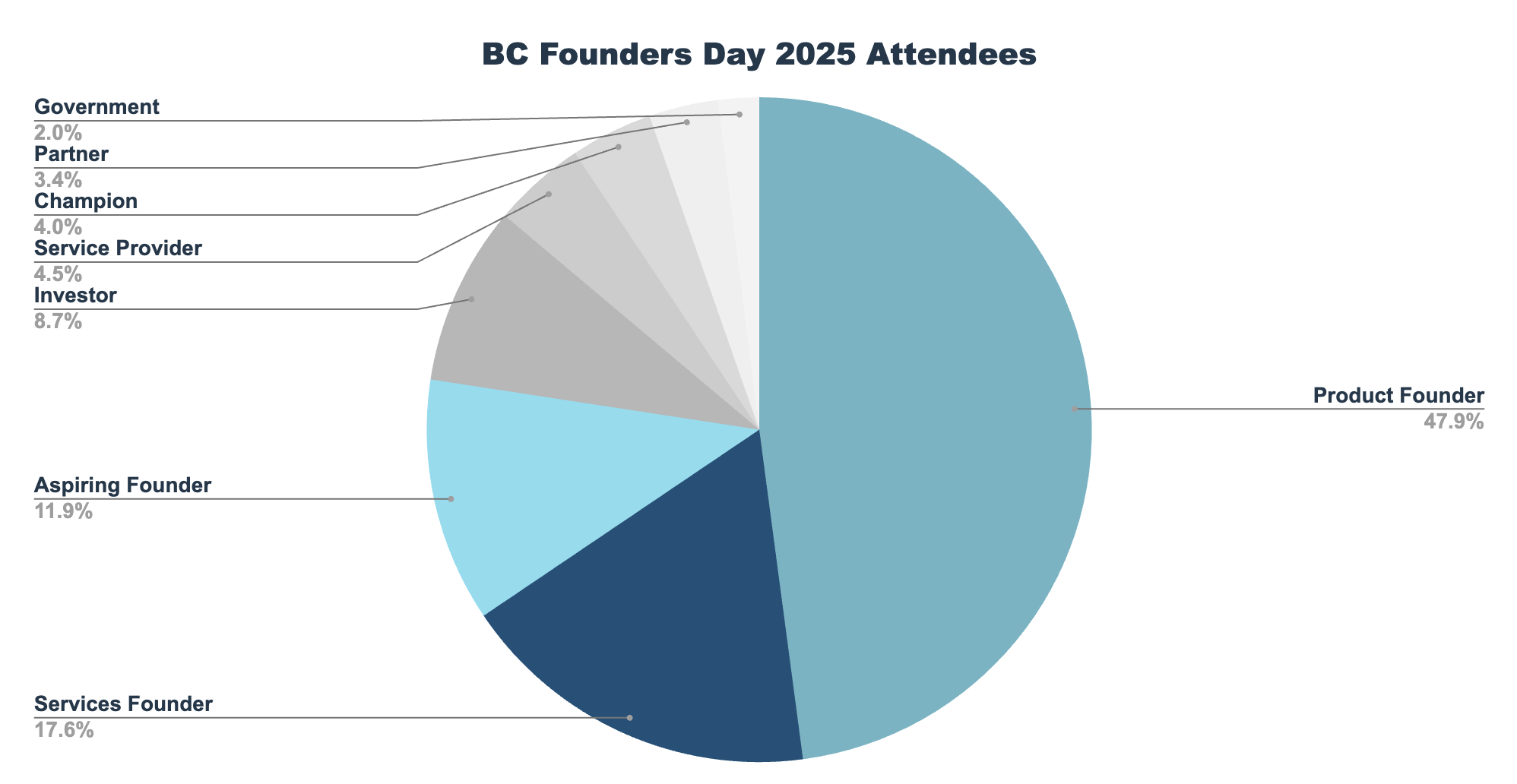

Let’s begin with a high-level breakdown of the registered attendees by their role in the ecosystem:

More than 65% of the event’s registered attendees — about 660 people — were confirmed, active founders. We broke that group down into two categories based on whether they founded a product company or a services company (a cohort that included consultancies, outsourced development shops and other service providers).

Another ~12% were aspiring founders. That group included students, individuals currently working full-time at a larger tech company and previously-exited founders considering starting something new.

8.7% of the attendees were VCs, angel investors and folks who work at local incubators/accelerators.

The remaining ~14% of registered attendees included non-founder service providers (recruiters, lawyers, salespeople, etc.), a group we refer to as “Champions” (individuals who either through occupation or by way of personal interest dedicate their time to supporting the local ecosystem), corporate partners and government representatives.

That’s a pretty good mix!

Location

Next up is location: where did this year’s attendees come from?

The vast majority of registered attendees — nearly 90% — came from the Greater Vancouver area (the city of Vancouver and it’s surrounding suburbs).

Another 1.6% traveled by boat, seaplane or helicopter to join us from the capital city of Victoria, while 5.1% of the attendees came from elsewhere in British Columbia.

A further 1.6% of attendees came from the rest of Canada (including former Wattpad co-founder and current deep tech investor Allen Lau, who made a 4,200 km day trip from Toronto to share his experiences).

The final ~2.2% of registered attendees were from outside of Canada (split evenly between the US and the rest of the world, at 1.1% each).

Founder Experience

To me, this was one of the coolest discoveries from our analysis.

We looked at the backgrounds of every single registered attendee to see if they had any founder experience at any point in their professional history. It turned out that ~78% of attendees to BC Founders Day 2025 had founded or cofounded at least one company 🤯.

Those companies weren’t all tech startups. Some had previously founded consulting companies. Others were the founders of media companies. A few had founded cough cough VC firms cough cough. The point is, ~780 of the registered attendees of BC Founders Day had founded something. And for a startup ecosystem, that’s amazing.

It truly was a gathering of founders.

Financing Stage

Last but not least, we dug into the progress made by the founders of product companies using fundraising as a (very imperfect) proxy. How far along are the companies and where is there source of funding?

Two quick notes on this before I go further:

The data below represents a combination of public and non-public data. It’s also imperfect. While I personally have knowledge of a number of unannounced funding rounds, there are undoubtedly others that I’m not privy to. So take this as an approximation.

The data reflects the companies that the founders are currently working on. Many attendees have progressed further in the past (raising multiple rounds of funding, exiting and even IPOing). But this data is all about what they’re working on right now.

With that out of the way, here’s what we found:

Once you move past the obvious reaction (“Wow…Chris must be colorblind”), what this data shows is a healthy, balanced and — most importantly — growing ecosystem.

About 35% of the founders have bootstrapped their companies. Some of them may eventually raise funding. Many won’t (either because their company isn’t a fit for investors or because they choose not to).

About 20% of the founders have financed their company thus far through a combination of angel investors, accelerators, incubators and/or grants (the latter something that is quite prevalent in British Columbia).

Nearly 14% of the founders have successfully raised Pre-Seed funding. Another 12% have raised a Seed round.

Once we get into the scaling and growth stages, the “graduation” rates approximate what we see globally in VC-backed startups.

Perhaps the most interesting insight from the data is that more than 14% of the registered attendees (nearly 150 founders) are currently building in stealth 👀. How do I know this? Some of those founders currently have “Stealth” listed on their LinkedIn profiles. Others…well, I can’t share all of my secrets 🤫

(Though I will note that a number of these stealth founders have already raised unannounced rounds of funding 🔥🔥🔥).

Overall, BC Founders Day 2025 was an incredible, invigorating event. For an ecosystem that’s often accused of being fragmented, it’s clear that a lot of founders across the region crave connectivity.

One last note: by far, my favorite panel of the day was comprised of three young, relatively unknown (for now) Gen Z founders. Each of these individuals is spearheading their own movement within the local ecosystem. And each of them was unapologetic about what they’re doing, why they’re doing it, and how it bears no resemblance whatsoever to what came before it.

A wise man once sang, “The Times, They Are A-Changin’”. The next generation of founders is grabbing the reins of ecosystems around the world — whether the old guard is ready or not. And that’s a great thing.

Even if the data doesn’t show it just yet.

Special thanks to our incredible corporate and government partners. BC Founders Day 2025 would not have been possible without their support: Google, RBCx, Fasken, Boast, Launch Academy, Innovate BC and Web Summit.

To get more of my thoughts on startups, the business of venture capital and tech ecosystems delivered to your inbox, subscribe to my newsletter.